Beyond Equity: Saas Financing for Tomorrow’s Tech Innovators

by siteadmin

In the ever-evolving landscape of technology financing, innovation has taken center stage. Startups to established enterprises are breaking barriers with groundbreaking solutions like true sale financing (TSF) and non dilutive capital, fueling rapid revenue acceleration and lightning-speed deal closures. This article delves into the HOW and WHY behind these transformative financial choices, featuring real partner stories to illustrate the profound impact of Ratio Tech's innovative offerings. Discover how TSF and non dilutive capital are rewriting the rules of tech financing, and explore the unlimited possibilities they bring to the world of B2B BNPL, all while making hardware affordable, enhancing flexibility, and reducing churn.

Revolutionizing SaaS Financing: Unlocking the Future

In an era where innovation knows no bounds, technology companies are seeking financing solutions that match their agility and ambition. True sale financing (TSF) and non dilutive capital have emerged as the catalysts reshaping the landscape. These solutions empower companies to accelerate their revenue streams, close deals swiftly, and forge a path towards sustained growth.

Making Hardware Affordable & Securing More Deals

Offer unlimited payment flexibility to your customers to win more deals faster. They get the tools, and you get the full value of the contract upfront.

Take, for instance, the case of Sorting Robotics, led by CEO Nohtal Partansky. Sorting Robotics aspired to democratize access to robotics-as-a-service. However, the high cost of hardware often posed a significant barrier during negotiations. In their pursuit of a solution, they joined forces with Ratio Tech.

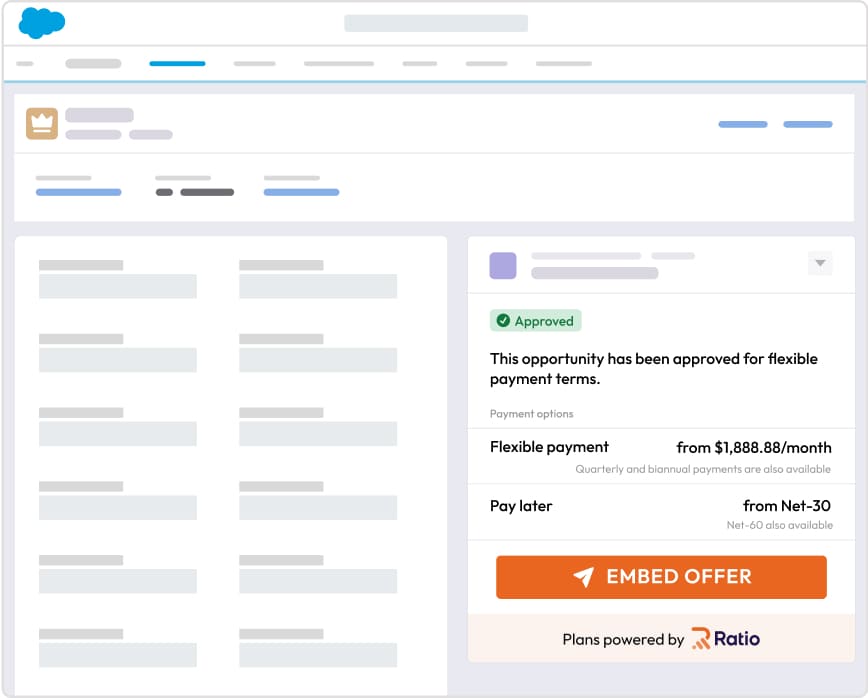

Ratio Tech's innovative offering, Ratio Boost, provided an answer. It allowed Sorting Robotics to embed financing directly into their sales process, offering unmatched payment flexibility to their customers. This strategic move not only secured more deals but also ensured that Sorting Robotics received the full contract value upfront, without compromising their pricing strategy. By sharing the financing fee or choosing to cover it themselves, Sorting Robotics had full control—all within their CRM.

Embedding Payment Flexibility in Tech Transactions

Robotics and hardware can be expensive. Ratio empowers you to land more deals by creating customized offers for every deal. You decide if you want to pass on the financing fee to the customer, split it, or cover it yourself. With our embedded solutions, you don’t even have to leave your CRM!

Take a page from Tuff Robotics, where CEO Kyle Dou recognized the potential of B2B BNPL solutions. Tuff Robotics aimed to assist companies facing labor challenges. To optimize workflow and extend their financial runway, they needed to develop and market their solution.

Kyle Dou turned to Ratio Tech's non dilutive capital, a strategic choice that allowed Tuff Robotics to accelerate their BNPL platform's development while retaining control. With the flexibility to collect upfront payments, Tuff Robotics expanded rapidly, addressing the needs of cash flow-sensitive customers.

Non Dilutive Funding Startups: Saas & Tech Innovators of the Future

Story 1: Empowering Robotics-as-a-Service with Ratio Tech

Client: Sorting Robotics, CEO: Nohtal Partansky

"No one else does it like Ratio," says Nohtal Partansky, CEO of Sorting Robotics. "Ratio fills a need in the Robotics-as-a-service industry that no one else does. And they do it well."

Sorting Robotics transitioned to Robotics-as-a-service, thanks to Ratio Tech. By embedding flexible payment options into every deal, they gave their customers more freedom while collecting cash upfront. This financial flexibility allowed them to reduce dilution and increase enterprise value.

Story 2: Unlocking Growth for Labor Solutions with Ratio Tech

Client: Tuff Robotics, CEO: Kyle Dou

Kyle Dou, CEO of Tuff Robotics, shares their journey: "We're a startup who helps companies with labor challenges. Ratio allows us to extend our financial runway, allowing us to further optimize workflow."

Tuff Robotics leveraged Ratio Tech's unique financing solutions to onboard quickly and gain immediate financial resources. They embedded payment options into every deal, enabling them to close more deals faster. With Ratio, they collect cash upfront, regardless of how the customer chooses to pay.

Story 3: Optimizing Sales Conversion with Ratio Tech

Client: Bigtincan, Founder & CEO: David Keane

David Keane, Founder & CEO of Bigtincan, explains how Ratio Tech helps transform the purchasing experience: "We see many ways to sell more deals faster by speeding up the procurement process for our customers. And we collect upfront, no matter how the customer pays."

Bigtincan leverages Ratio Tech's financing solutions to streamline sales conversion. By making the procurement process more efficient, they attract more customers and secure deals faster.

Story 4: Ensuring Control of Growth with Ratio Tech

Client: Bitivore, CEO: Oz Eleonora

"As a software company, liquidity is paramount to fueling our growth," states Oz Eleonora, CEO of Bitivore. "But raising capital can be expensive, dilutive, and unpredictable. With Ratio, we optimize cash flow without dilution, putting us in control."

Bitivore utilizes Ratio Tech's solutions to leverage recurring revenues for growth. This non-dilutive financing process is accretive to sales conversion and empowers companies to steer their destiny.

Story 5: The Affiliates' Advantage with Ratio Tech

Client: AIPartnership, Mark Ellington (CFO) and Tom Corr (CEO)

Mark Ellington, CFO at AIPartnership, highlights Ratio Tech's impact: "Every technology company should consider Ratio to optimize their capital structure and boost growth."

Tom Corr, CEO of AIPartnership, emphasizes the payment flexibility Ratio provides to affiliates. It allows them to collect cash upfront while accommodating diverse customer preferences.

Story 6: Enhancing Customer Experience with Ratio Tech

Client: Barkibu, Co-CEO: Alvaro Gutierrez

"Our customers love the payment flexibility that Ratio provides," shares Alvaro Gutierrez, Co-CEO of Barkibu. "And we love collecting the cash upfront."

Barkibu enhances its customer experience by offering flexible payment options. It's a win-win, benefiting both the company and its customers.

Story 7: Leveraging Recurring Revenues for Growth

Client: Brainshark, Head of Finance: Richard Whalen

"With Ratio, we leverage recurring revenues to fuel our growth, optimize cash flow, and improve sales conversion," explains Richard Whalen, Head of Finance at Brainshark.

Brainshark harnesses the power of recurring revenues with Ratio Tech, using them to optimize various aspects of their business.

Story 8: A Powerful Strategy for SaaS Companies

Client: Splunk, Former CEO: Doug Merritt

Doug Merritt, Former CEO of Splunk, acknowledges Ratio Tech's role: "Ratio offers a powerful, often untapped, strategy for SaaS companies to accelerate sales and growth financing."

Story 9: The Win-Win Situation with Ratio Tech

Client: Webscale, Board Member/Former CEO: Sonal Puri

"Every SaaS company should partner with Ratio because it’s a true win-win situation," asserts Sonal Puri, Board Member/Former CEO of Webscale. "Our customers get the terms and flexibility they need, and we get the cash upfront without dilution and zero risk."

Webscale exemplifies the mutual benefits that Ratio Tech's financing solutions offer. They prioritize customer satisfaction and financial stability.

Story 10: Gaining a Competitive Edge

Client: Talk Desk, Board Member: Tom Rilley

"B2B SaaS sellers will really appreciate the competitive advantage they gain with Ratio’s customer-centric flexible payment options," notes Tom Rilley, Board Member at Talk Desk.

"Every SaaS company can use Ratio."

Ratio Tech empowers B2B SaaS sellers with competitive advantages, enabling them to stand out in the market.

Conclusion: Shaping the Future of Tech Financing

In this ever-changing landscape, true sale financing and non dilutive capital are revolutionizing how tech innovators fuel their growth. These financial tools offer unlimited payment flexibility, reduce churn, close deals faster, and accelerate revenue. By embracing Ratio Tech's TSF and non dilutive capital solutions, tech companies are reshaping the rules of the game and paving the way for a future where innovation knows no bounds.

In the ever-evolving landscape of technology financing, innovation has taken center stage. Startups to established enterprises are breaking barriers with groundbreaking solutions like true sale financing (TSF) and non dilutive capital, fueling rapid revenue acceleration and lightning-speed deal closures. This article delves into the HOW and WHY behind these transformative financial choices, featuring real partner…

Recent Posts

- Your Premier Roofing Contractor for Comprehensive Roofing Solutions

- How to Find Roses for Every Occasion

- Toms River NJ Roofers Pros: Setting the Standard for Excellence in Roofing

- The Law Office of Kevin R. Garbe, PLLC: Providing Expert Legal Services in Real Estate and Estate Planning on Long Island

- Modern Laundry Revolutionizes Laundry Services in Windsor, CT